TORONTO, CANADA, October 21, 2015: Cordoba Minerals Corp. ("Cordoba" or the "Company") (TSX-V: CDB) is pleased to announce that it has entered into an option agreement with Sociedad Ordinaria de Minas Omni ("OMNI") to purchase the Alacran Copper-Gold Project ("Alacran" or the "Alacran Project") which is located within Cordoba's San Matias Project. The acquisition enables Cordoba to consolidate the entire San Matias Copper-Gold District in the Department of Cordoba in the northwest of Colombia. Cordoba believes that the Alacran Project remains largely untested and has the potential to host a large scale copper-gold resource.

"The acquisition of the Alacran Project is an important step forward for Cordoba as it adds another high quality project to our portfolio of copper-gold exploration assets in Colombia," said Mario Stifano, Cordoba's President and CEO.

HIGHLIGHTS

Alacran Copper-Gold Project

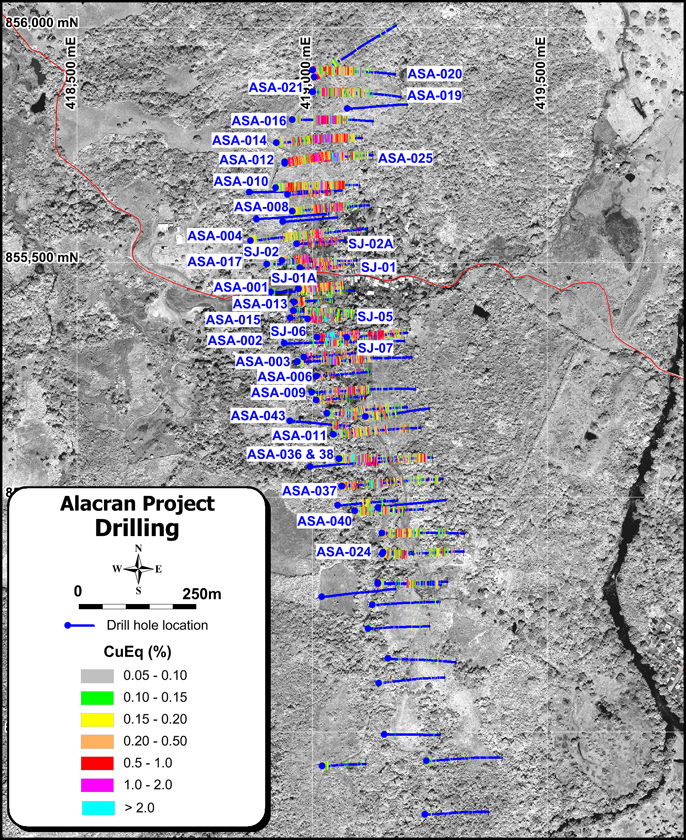

The Alacran Copper-Gold Project is located within the tenure of the Company's San Matias Copper-Gold Project in the Department of Cordoba, Colombia. Over 13,000 metres of diamond drilling has been carried out at the project to date (see Table 1) including 139 metres of 1.23% Cu and 0.74 g/t Au in SJ-006, 188 metres of 0.71% Cu and 0.25 g/t Au in ASA-012 and 128 metres of 0.84% Cu and 0.45 g/t Au in ASA-0141.

The majority of the intersected mineralization has only been tested to an average vertical depth of 150 metres, with the deepest intersections only 240 metres below surface. Mineralization is traced over a strike length of greater than 1,300 metres. The copper-gold mineralization defined to date represents an excellent opportunity for Cordoba to delineate a large high-grade, copper-gold resource that has the potential to grow significantly as the deposit is open in almost all directions.

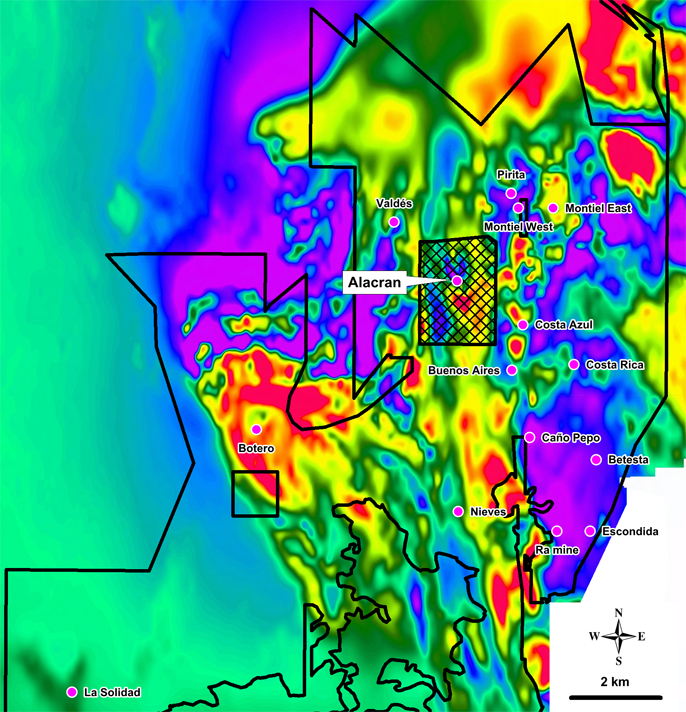

Alacran is approximately two kilometres southwest of the Company's Montiel discovery, where recent drilling interested 101 metres of 1.0% Cu and 0.65 g/t Au, and two kilometres west of Costa Azul where recent drilling interested 87 metres of 0.62% Cu and 0.51 g/t Au1 . An initial 3,000 metre diamond drilling program to confirm the known mineralization and test for both vertical and strike extensions is expected to commence in mid-November, 2015.

Option Terms

Cordoba has acquired an option (the "Option") to earn a 100% interest in the Alacran Project by completing the following commitments and can drop the Option at anytime without penalty:

- A US$250,000 payment to OMNI on signing of the Binding Letter of Intent (LOI) and additional US$250,000 payments on completion of the Definitive Agreement and 24-month anniversary of signing the LOI.

- A 3,000-metre drill program to commence within 90 days and completion of a total of 8,000 metres within two years from signing of LOI.

- A US$1,000,000 payment to OMNI on the 24-month anniversary of completion of the Definitive Agreement.

- Cordoba will file with the Colombian government for the relevant approvals to conduct activities of construction and commercial production at Alacran before June 30, 2018.

- A US$14,000,000 payment to OMNI when the environmental license and all other approvals, permits or licenses required to commence the construction and operation of a commercial mine at Alacran have been granted on a final basis by the Colombian government.

- OMNI will retain a 2% net smelter royalty with advance royalty payments of US$500,000 commencing three years after receipt of approvals to commence construction at Alacran or six years after filing for approval to commence construction at Alacran.

To finance the Option for Alacran, Cordoba has agreed to enter into a C$1,600,000 private placement by issuing 13,333,333 common shares at C$0.12 per common share (the "Private Placement"). High Power Exploration Inc. ("HPX"), a private mineral exploration company indirectly controlled by mining entrepreneur Robert Friedland has agreed to purchase up to 100% of the Private Placement.

The net proceeds of the Private Placement will be used by the Company to help finance its planned Alacran exploration program in Colombia and for general working capital purposes. Closing of the Private Placement is subject to the approval of the TSX Venture Exchange. The common shares issued will be subject to a hold period under applicable securities laws, which will expire four months plus one day from the closing date of the Private Placement.

ALACRAN COPPER-GOLD PROJECT

The Alacran Copper-Gold Project is located within a 390-hectare mining title (2.3 km x 1.7 km) in the northern central parts of the San Matias Project (Fig. 1). The copper-gold mineralization is associated with stratabound replacement of a marine volcano-sedimentary geological sequence in the core of a faulted antiformal fold structure. The deposit comprises moderate to steeply dipping stratigraphy that is mineralized as a series of sub-parallel replacement-style or manto deposits and associated disseminations. The copper-gold mineralization is composed of largely chalcopyrite ± pyrrhotite with associated metasomatic magnetite and distal disseminated pyrite. High temperature biotite-amphibole-K feldspar alteration in the host geological sequence, and in adjacent geology, indicate that the copper-gold mineralization is proximal to a source intrusion.

Mineralization occurs within all members of the sedimentary sequence, where it can be traced over a strike length of greater than 1,300 metres and local thickness of more than 80 metres from the current drilling. An initial 3,000-metre diamond drilling campaign is planned to start in mid-November to test for both strike and vertical extensions of the mineralization, largely within the central and northern parts of the deposit, where the best opportunity of significant widths of higher-grade mineralization are present.

Figure 1. Locations of the Alacran copper-gold deposit and associated title (hatched) within the San Matias Project of Cordoba Minerals on airborne RTP magnetics.

The Alacran deposit remains open vertically, where the average depth of mineralization has only been drilled to 150 metres and copper-gold mineralization remains open over the entire strike length. The northern parts of the deposit also remain open, where some of the best copper-gold intersections have been intersected to date (Fig. 2), and the interpreted mineralization has not been tested adequately by drilling. The southern extents of the deposit have received only minimal drilling to date and further extensions are possible. Additionally, deep tropical weathering of the deposit also presents the potential for a supergene gold enriched zone, which may indicate an oxide gold resource being established.

An in-house historical inferred resource calculation was previously made by OMNI of 37.0 million tonnes @ 0.62% Cu and 0.40 g/t Au (0.9% copper equivalent (CuEq)) is interpreted by Cordoba's management to be representative of the drilling completed to date.

All resource estimates quoted herein are based on prior data and reports obtained and prepared by previous operators. The Company has not completed the work necessary to verify the classification of the mineral resource estimates. The Company is not treating the mineral resource estimates as a current resource estimate verified by a qualified person.

The Company's planned initial 3,000 metre diamond drilling program is designed to allow estimation of the historical inferred resource -- originally established through drilling by OMNI -- in line with current guidelines set by the Canadian Institute of Mining, Metallurgy and Petroleum (CIM).

Figure 2. Historical diamond drilling at the Alacran project showing the significant drillholes to date.

Table 1: Significant diamond drill hole results at the Alacran project*

| Drill-hole | From | To | Interval** | Copper | Gold |

|---|---|---|---|---|---|

| (m) | (m) | (m) | (%) | (g/t) | |

| ASA-001 | 127 | 141 | 15 | 1.20 | 0.31 |

| ASA-002 | 121 | 156 | 35 | 1.41 | 0.56 |

| ASA-003 | 82 | 134 | 52 | 0.81 | 0.73 |

| 168 | 177 | 10 | 1.69 | 0.08 | |

| 187 | 204 | 17 | 0.47 | 0.13 | |

| ASA-004 | 179 | 229 | 50 | 0.30 | 0.42 |

| ASA-005 | 197 | 216 | 19 | 0.27 | 0.44 |

| ASA-006 | 66 | 83 | 17 | 0.52 | 0.22 |

| 98 | 128 | 30 | 0.62 | 1.04 | |

| ASA-007 | 59 | 68 | 10 | 0.58 | 0.80 |

| 89 | 114 | 26 | 0.38 | 0.88 | |

| ASA-008 | 79 | 115 | 36 | 0.53 | 0.44 |

| 124 | 203 | 79 | 0.76 | 0.37 | |

| ASA-009 | 60 | 79 | 19 | 0.29 | 2.01 |

| 103 | 129 | 26 | 0.70 | 1.39 | |

| ASA-010 | 28 | 100 | 72 | 0.55 | 0.11 |

| 143 | 236 | 93 | 0.43 | 0.20 | |

| ASA-011 | 38 | 81 | 43 | 0.38 | 0.56 |

| ASA-012 | 10 | 198 | 188 | 0.71 | 0.25 |

| 222 | 237 | 15 | 0.55 | 0.24 | |

| ASA-013 | 97 | 115 | 18 | 2.14 | 0.59 |

| ASA-014 | 51 | 86 | 35 | 1.49 | 0.11 |

| 123 | 251 | 128 | 0.84 | 0.45 | |

| ASA-015 | 94 | 104 | 10 | 1.03 | 0.20 |

| 112 | 125 | 36 | 0.83 | 0.40 | |

| ASA-016 | 99 | 202 | 103 | 1.00 | 0.41 |

| ASA-017 | 110 | 151 | 41 | 0.44 | 0.18 |

| 194 | 203 | 9 | 1.09 | 0.48 | |

| ASA-018 | 78 | 94 | 16 | 0.33 | 0.26 |

| ASA-019 | 39 | 124 | 85 | 1.07 | 0.19 |

| ASA-020 | 55 | 71 | 16 | 0.50 | 0.11 |

| 87 | 100 | 13 | 0.61 | 0.24 | |

| ASA-021 | 41 | 91 | 50 | 0.67 | 0.14 |

| 126 | 153 | 27 | 0.75 | 0.21 | |

| ASA-022 | 48 | 72 | 24 | 0.33 | 0.35 |

| ASA-024 | 50 | 81 | 31 | 0.52 | 0.18 |

| ASA-025 | 14 | 63 | 49 | 0.58 | 0.07 |

| 127 | 258 | 131 | 0.52 | 0.23 | |

| ASA-036 | 58 | 126 | 68 | 0.64 | 0.88 |

| 243 | 279 | 36 | 0.44 | 0.12 | |

| ASA-037 | 89 | 131 | 42 | 0.43 | 2.83 |

| 187 | 197 | 10 | 0.74 | 0.22 | |

| ASA-038 | 49 | 84 | 35 | 0.40 | 2.23 |

| 115 | 151 | 36 | 0.47 | 0.44 | |

| 182 | 189 | 7 | 1.05 | 0.36 | |

| ASA-039 | 47 | 52 | 5 | 0.80 | 1.50 |

| 186 | 188 | 2 | 2.87 | 0.58 | |

| ASA-040 | 22 | 54 | 32 | 0.10 | 0.55 |

| ASA-043 | 182 | 210 | 28 | 0.52 | 0.62 |

| SJ-001 | 18.9 | 54.9 | 36 | 0.69 | 0.22 |

| 61.6 | 147 | 85.4 | 0.44 | 0.12 | |

| SJ-001A | 30.5 | 148 | 117.5 | 0.40 | 0.17 |

| SJ-002 | 40.5 | 90.3 | 49.8 | 0.60 | 0.35 |

| SJ-002A | 6.24 | 144 | 137.76 | 0.35 | 0.28 |

| SJ-005 | 6.4 | 107 | 100.6 | 1.20 | 0.53 |

| SJ-005W | 78.9 | 91.9 | 13 | 1.35 | 0.66 |

| SJ-006 | 0.61 | 140 | 139.39 | 1.23 | 0.74 |

| SJ-007 | 0 | 29.5 | 29.5 | 0.23 | 0.24 |

| 59.1 | 144 | 84.9 | 0.47 | 0.52 | |

| SJ-008 | 36.6 | 60.7 | 24.1 | 0.64 | 0.37 |

| * True width intervals of the mineralisation are not fully defined from the information available at present. ** Intercepts calculated at 0.3% CuEq cut-off with maximum internal dilution of 5m |

|||||

Joint Venture with HPX

HPX has the option to enter into a joint venture with the Company to earn up to a 65% interest in Cordoba's San Matias Copper-Gold Project in Colombia by funding the project and completing a feasibility study (see May 8, 2015 news release). The Alacran property falls within the joint venture area of interest and shall form part of the joint venture when HPX proceeds to the joint venture phase. HPX will also be acquiring a 19.9% interest in OMNI through the purchase of shares from existing OMNI shareholders.

Grant of Stock Options

The Company also announces that it has granted an aggregate of 450,000 stock options to certain directors of the Company, each entitling the holder to purchase one common share of the Company. The options are exercisable at a price per share equal to the closing price of the common shares of the Company on the TSX Venture Exchange on October 23, 2015, and shall be exercisable from time to time and at any time from and after the date of vesting thereof until 5:00 p.m. (Toronto time) on the date which is the tenth anniversary of the date of grant.

About San Matias Project

The newly discovered San Matias Copper-Gold Project comprises a 20,000-hectare land package on the inferred northern extension of the prolific and richly endowed Mid Cauca Belt. The San Matias Project area contains several known areas of porphyry copper-gold mineralization, copper-gold replacement or skarn style and vein hosted gold-copper mineralization. Porphyry mineralization at the San Matias Project incorporates high-grade zones of copper-gold mineralization hosted by diorite porphyries that contain strong potassic style alteration and various orientations of sheeted and stockwork quartz-magnetite veins with chalcopyrite-bornite mineralization and minor zones of K-feldspar within vein margins and secondary biotite. Lesser calc-sodic alteration is also noted as trace actinolite and albite alteration zones, largely in basaltic wallrocks and inclusions. At least one later phase of chalcopyrite veining overprints the sheeted and stockwork quartz-magnetite veins. A second, more felsic intrusive mineralized phase has also been identified which contains lesser quartz-magnetite veining associated with chalcopyrite and pyrite and a more well developed dissemination of chalcopyrite-pyrite. Potassic alteration, as secondary biotite, is well developed along with minor zones of chlorite-epidote alteration. Within the diorite porphyry, zones of intense sheeted quartz veining often reaches over 90% replacement of the intrusive host rock associated with strong potassic alteration and copper-gold mineralization. The nature of mineralization and related alteration encountered at Montiel is similar to other large high-grade copper-gold porphyry deposits.

Qualified Person and Technical Information

The technical information has been reviewed, verified and compiled by Christian J. Grainger, PhD, a Qualified Person for the purpose of NI 43-101. Dr. Grainger is Cordoba's Vice President of Exploration and is a geologist with over 15 years in the minerals mining, consulting, exploration and research industries. Dr. Grainger is a Member of the Australian Institute of Geoscientists and Australian Institute of Mining and Metallurgy. Dr. Grainger has verified the technical data in this news release related to the historical Mineral Resource estimate disclosed herein.

About Cordoba Minerals

Cordoba Minerals Corp. is a Toronto-based mineral exploration company focused on the exploration and acquisition of copper and gold projects in Colombia. Cordoba currently owns 100% of the highly prospective San Matias Project located near operating open pit mines with ideal topography in the Department of Cordoba. For further information, please visit www.cordobaminerals.com.

ON BEHALF OF THE COMPANY

Mario Stifano, President and CEO

Cordoba Minerals Corp.

Email: info@cordobamineralscorp.com

Website: www.cordobaminerals.com

Neither the TSX Venture Exchange nor the Investment Industry Regulatory Organization of Canada accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements

This news release includes certain "forward-looking information" within the meaning of Canadian securities legislation. Forward-looking statements include predictions, projections and forecasts and are often, but not always, identified by the use of words such as "seek", "anticipate", "believe", "plan", "estimate", "forecast", "expect", "potential", "project", "target", "schedule", budget" and "intend" and statements that an event or result "may", "will", "should", "could" or "might" occur or be achieved and other similar expressions and includes the negatives thereof. All statements other than statements of historical fact included in this release, including, without limitation, statements regarding the potential of the Company's properties are forward-looking statements that involve various risks and uncertainties. There can be no assurance that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Forward-looking statements are based on a number of material factors and assumptions. Important factors that could cause actual results to differ materially from Company's expectations include actual exploration results, changes in project parameters as plans continue to be refined, future metal prices, availability of capital and financing on acceptable terms, general economic, market or business conditions, uninsured risks, regulatory changes, delays or inability to receive required approvals, and other exploration or other risks detailed herein and from time to time in the filings made by the Company with securities regulators. Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ from those described in forward-looking statements, there may be other factors that cause such actions, events or results to differ materially from those anticipated. There can be no assurance that forward-looking statements will prove to be accurate and accordingly readers are cautioned not to place undue reliance on forward-looking statements which speak only as of the date of this news release. The Company disclaims any intention or obligation, except to the extent required by law, to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

1 True width intervals of the mineralization are not fully defined from the information available at present.