ACD133 Reports 150.60 Metres of 0.86% Copper Equivalent1

(0.72% Copper, 0.27 g/t Gold and 5.27 g/t Silver)

VANCOUVER, CANADA – Sarah Armstrong-Montoya, President and Chief Executive Officer of Cordoba Minerals Corp. (TSXV:CDB; OTCQB:CDBMF; otherwise “Cordoba” or the “Company”), is pleased to report additional assay results received from the ongoing initial in-fill drilling program at the 100%-owned San Matias Copper-Gold-Silver Project.

Highlights:

Significant intercepts returned from the additional drill holes include (Table 1):

- ACD133 – 150.60 metres (“m”) from 40.45 m to 191.05 m with 0.72% copper (“Cu”), 0.27 g/t gold (“Au”) and 5.27 g/t silver (“Ag”), or 0.86% copper equivalent1 (“CuEq”), including:

- 44.38 m from 46.33 m to 90.71 m with 1.48% Cu, 0.62 g/t Au and 11.23 g/t Ag, or 1.81% CuEq1,

- 16.00 m from 114.00 m to 130.00 m with 0.87% Cu, 0.41 g/t Au and 4.56 g/t Ag, or 1.09% CuEq1.

Assay results continue to demonstrate high-grade copper-gold mineralization within the Alacran Deposit and confirm the strong correlation with the Pre-Feasibility Study (“PFS”) block model.

“As our initial drill program is nearing completion, I’m delighted that the assay results continue to confirm the PFS block model, and highlight the quality of the project,” commented Ms. Sarah Armstrong-Montoya, President and CEO of Cordoba. “In addition, our teams are advancing the Feasibility Study technical program, Environmental Impact Assessment permitting, and community engagement activities to move the project forward to the next milestone.”

Assay results confirm the correlation with the PFS block model.

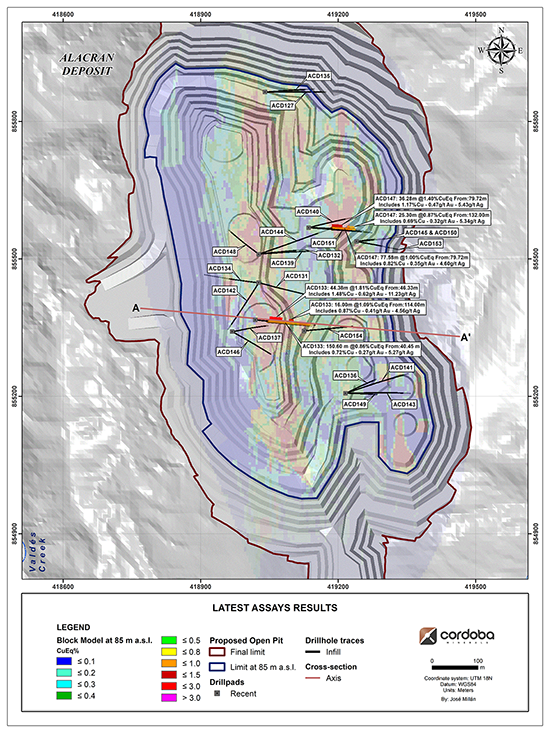

To date, Cordoba has completed 25,929 m in 127 diamond drill holes of the initial in-fill drilling campaign (Figure 1). Assay results continue to demonstrate high-grade copper-gold mineralization within the core of the Alacran Deposit and confirm the strong correlation with the PFS block model.

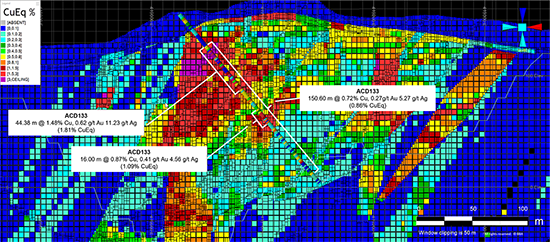

Drill hole ACD133 shows a strong correlation with the PFS block model by intersecting 150.60 m of the tuffs and carbonaceous mudstone beds of “Unit 2” of the Alacran Deposit from 40.45 m to 191.05 m (Figure 2), with highly enriched grades of copper, gold and silver that correlate well with the local block model (Figure 3). Much of this shallow high-grade material starts within 30 m to 40 m of the surface.

Drill hole ACD147 returned 36.28 m of 1.40% CuEq1 between 79.72 m and 116.00 m of a tuff bed within “Unit 2”, which has been partially replaced by semi-massive sulfide comprising pyrite, chalcopyrite and pyrrhotite (Figure 4).

These assay results will be included in the next mineral resource model update after the completion of the current drilling program. The ongoing Feasibility Study will determine the potential for early access to the shallow high-grade zones.

The initial drilling program is nearing completion and will be transitioning to focus on the peripheral in-fill areas of the Alacran Deposit to estimate the life of mine average grade of the deposit.

Table 1: Drill results of the latest drill holes from the 2022 Alacran Deposit in-fill drill program.

| Hole | From (m) |

To (m) |

Interval2 (m) |

Cu (%) |

Au (g/t) |

Ag (g/t) |

CuEq1 (%) |

|---|---|---|---|---|---|---|---|

| ACD127 | 19.50 | 121.91 | 83.11 | 0.77 | 0.30 | 4.72 | 0.92 |

| Including | 59.75 | 100.73 | 39.58 | 1.16 | 0.40 | 7.29 | 1.37 |

| ACD 131 | 7.00 | 100.30 | 93.30 | 0.69 | 0.27 | 4.86 | 0.84 |

| Including | 7.00 | 23.90 | 16.90 | 0.78 | 0.41 | 6.53 | 1.00 |

| Including | 46.40 | 100.30 | 53.90 | 0.95 | 0.34 | 6.31 | 1.13 |

| ACD132 | 9.10 | 173.33 | 156.83 | 0.41 | 0.38 | 3.00 | 0.63 |

| Including | 10.60 | 80.40 | 62.40 | 0.63 | 0.84 | 4.66 | 1.13 |

| Including | 161.55 | 173.33 | 11.78 | 0.71 | 0.17 | 4.38 | 0.79 |

| ACD133 | 40.45 | 191.05 | 150.60 | 0.72 | 0.27 | 5.27 | 0.86 |

| Including | 46.33 | 90.71 | 44.38 | 1.48 | 0.62 | 11.23 | 1.81 |

| Including | 114.00 | 130.00 | 16.00 | 0.87 | 0.41 | 4.56 | 1.09 |

| ACD134 | 3.40 | 50.40 | 47.00 | 0.29 | 0.11 | 4.53 | 0.37 |

| Including | 26.20 | 31.30 | 5.10 | 0.89 | 0.23 | 5.16 | 0.99 |

| ACD135 | 17.00 | 146.95 | 108.65 | 0.48 | 0.18 | 3.00 | 0.57 |

| Including | 69.45 | 140.95 | 71.50 | 0.57 | 0.22 | 3.42 | 0.68 |

| ACD136 | 28.97 | 160.00 | 131.03 | 0.58 | 0.13 | 2.19 | 0.63 |

| Including | 75.00 | 120.00 | 45.00 | 0.96 | 0.19 | 2.74 | 1.02 |

| ACD137 | 129.70 | 150.20 | 20.50 | 0.49 | 0.36 | 2.16 | 0.68 |

| ACD139 | 10.87 | 152.22 | 141.35 | 0.55 | 0.18 | 4.35 | 0.64 |

| ACD140 | 52.15 | 139.14 | 86.99 | 0.35 | 0.12 | 2.37 | 0.41 |

| Including | 121.14 | 139.14 | 18.00 | 0.69 | 0.22 | 5.90 | 0.81 |

| ACD141 | 53.55 | 147.00 | 93.45 | 0.25 | 0.11 | 0.68 | 0.30 |

| Including | 53.55 | 88.50 | 34.95 | 0.38 | 0.22 | 0.78 | 0.49 |

| Including | 141.00 | 153.00 | 12.00 | 0.52 | 0.06 | 2.35 | 0.53 |

| ACD142 | 0.00 | 21.00 | 21.00 | 0.22 | 0.75 | 5.10 | 0.73 |

| Including | 0.00 | 7.90 | 7.90 | 0.00 | 1.72 | 5.44 | 1.15 |

| Including | 12.50 | 21.00 | 8.50 | 0.55 | 0.21 | 6.43 | 0.67 |

| ACD143 | 60.80 | 194.65 | 133.85 | 0.29 | 0.08 | 0.95 | 0.32 |

| ACD144 | 12.00 | 100.80 | 83.90 | 0.46 | 0.21 | 3.51 | 0.58 |

| Including | 12.00 | 20.20 | 7.50 | 1.34 | 1.58 | 5.26 | 2.23 |

| Including | 81.00 | 97.00 | 16.00 | 0.79 | 0.14 | 6.84 | 0.85 |

| ACD145 | 32.25 | 89.35 | 57.10 | 0.37 | 0.12 | 2.49 | 0.43 |

| ACD146 | 138.65 | 165.10 | 26.45 | 0.39 | 0.30 | 1.97 | 0.55 |

| ACD147 | 79.72 | 157.30 | 77.58 | 0.82 | 0.35 | 4.60 | 1.00 |

| Including | 79.72 | 116.00 | 36.28 | 1.17 | 0.47 | 5.43 | 1.40 |

| Including | 132.00 | 157.30 | 25.30 | 0.69 | 0.32 | 5.34 | 0.87 |

| ACD148 | 46.00 | 143.60 | 97.60 | 0.42 | 0.15 | 4.93 | 0.50 |

| Including | 46.00 | 99.00 | 53.00 | 0.57 | 0.21 | 6.64 | 0.69 |

| Including | 134.10 | 143.60 | 9.50 | 0.89 | 0.24 | 9.93 | 1.03 |

| ACD149 | 26.45 | 157.00 | 130.55 | 0.35 | 0.12 | 1.09 | 0.40 |

| Including | 26.45 | 43.10 | 16.65 | 0.48 | 0.23 | 1.52 | 0.60 |

| Including | 58.47 | 79.25 | 20.78 | 0.63 | 0.28 | 1.57 | 0.76 |

| Including | 88.00 | 101.40 | 13.40 | 0.82 | 0.23 | 2.20 | 0.91 |

| ACD150 | 30.60 | 99.16 | 68.56 | 0.31 | 0.17 | 2.02 | 0.40 |

| ACD151 | 79.88 | 186.10 | 106.22 | 0.27 | 0.24 | 3.31 | 0.42 |

| Including | 97.10 | 109.10 | 12.00 | 0.60 | 0.22 | 2.33 | 0.70 |

| Including | 159.60 | 186.10 | 26.50 | 0.23 | 0.55 | 8.99 | 0.60 |

| ACD153 | 56.16 | 72.35 | 16.19 | 0.49 | 0.22 | 3.41 | 0.61 |

| ACD154 | 56.00 | 162.30 | 106.30 | 0.43 | 0.20 | 2.82 | 0.54 |

| Including | 56.00 | 74.96 | 18.96 | 0.32 | 0.15 | 3.39 | 0.41 |

| Including | 128.20 | 162.30 | 34.10 | 0.98 | 0.47 | 5.93 | 1.22 |

Figure 1: Plan view of the significant intercepts from the additional drill holes.

Figure 2: Cross section A – A’ of ACD 133

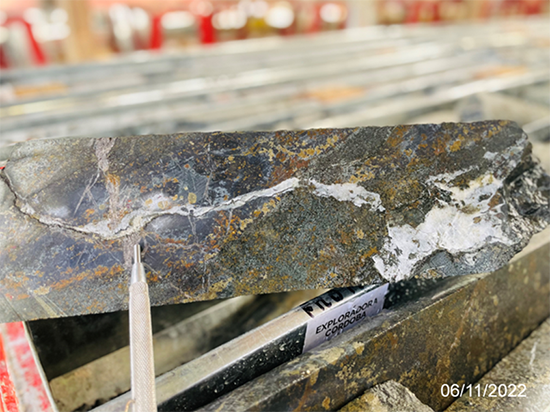

Figure 3: Hole ACD133 at 48.75 m showing a “Unit 2” carbonaceous mudstone preferentially replaced with chalcopyrite, mushketovite and pyrite. This sample was part of a 1.05 m interval from 48.75 m to 49.80 m, which returned 4.25% Cu, 2.36 g/t Au, 27.2 g/t Ag, or 5.30% CuEq1.

Figure 4: Hole ACD147 at 105.5 m showing fine tuff replaced with semi-massive pyrite, chalcopyrite and pyrrhotite. This sample was part of a 1 m interval from 105.50 m to 106.50 m, which returned 1.93% Cu, 0.88 g/t Au, 11.45 g/t Ag, or 2.39% CuEq1.

Technical Information & Qualified Person

The technical information in this release has been reviewed, verified and approved by Mark Gibson, P.Geo., a Qualified Person for the purpose of National Instrument 43-101 – Standards of Disclosure for Mineral Project (“NI 43-101”). Mr. Gibson is the Chief Operating Officer of Cordoba and of Ivanhoe Electric Inc., Cordoba’s majority shareholder, and is not considered independent under NI 43-101. Mr. Gibson verified the data disclosed which includes a review of the sampling, analytical and test data underlying the information and opinions contained therein.

Quality Assurance/Quality Control

Cordoba uses ALS Minerals Laboratory in Medellin, Colombia, ALS Minerals Laboratory in Lima, Peru, and SGS Colombia S.A.S in Medellin, Colombia. These labs operate in accordance with ISO/IEC 17025.

Cordoba employs a comprehensive industry standard Quality Assurance/Quality Control (QA/QC) program. PQ and HQ diamond drill core is cut lengthwise into 3 fractions, 1/4 is sent to geochemistry, half is sent to metallurgy, and 1/4 is left behind in a secure facility for future assay verification.

Some sample shipments are delivered to ALS Minerals Laboratory in Medellin, Colombia where the samples are prepared. Analysis occurs at the ALS Minerals Laboratory in Lima, Peru.

Alternate sample shipments are delivered to SGS Colombia S.A.S in Medellin, Colombia where the samples are prepared and analyzed.

Both analytical labs determine the gold by a 50 g fire assay with an AAS finish. An initial multi-element suite comprising copper, molybdenum, silver, and additional elements are analyzed by four-acid digestion with an ICP-MS finish. All samples with copper values over 10,000 ppm and gold greater than 10 ppm are subjected to an overlimit method for higher grades, which also uses a four-acid digest with an ICP-ES finish, and fire test with gravimetric finish. Certified reference materials, blanks, and duplicates are randomly inserted at the geologist's discretion and QA/QC geologist's approval into the sample stream to control laboratory performance (15%).

About Cordoba

Cordoba Minerals Corp. is a mineral exploration company focused on the exploration, development and acquisition of copper and gold projects. Cordoba is developing its 100%-owned San Matias Copper-Gold-Silver Project, which includes the Alacran deposit and satellite deposits at Montiel East, Montiel West and Costa Azul, located in the Department of Cordoba, Colombia. Cordoba also holds a 51% interest in the Perseverance Copper Project in Arizona, USA, which it is exploring through a Joint Venture and Earn-In Agreement. For further information, please visit www.cordobaminerals.com.

ON BEHALF OF THE COMPANY

Sarah Armstrong-Montoya, President and Chief Executive Officer

Information Contact

Ran Li +1-604-689-8765

info@cordobamineralscorp.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accept responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements

This news release includes “forward-looking statements” and “forward-looking information” within the meaning of Canadian securities legislation. All statements included in this news release, other than statements of historical fact, are forward-looking statements including, without limitation, but not limited to, statements with respect to the preparation of an updated mineral resource statement; geological interpretations; Feasibility Study; Environmental Impact Assessment permitting; community engagement activities; results of the current exploration and interpretations thereof; mineralization potential; and contemplated drilling and development programs. Forward looking-statements include predictions, projections and forecasts and are often, but not always, identified by the use of words such as "anticipate", "believe", "plan", "estimate", "expect", "potential", "target", "budget" and "intend" and statements that an event or result "may", "will", "should", "could" or "might" occur or be achieved and other similar expressions and includes the negatives thereof.

Forward-looking statements are based on a number of assumptions and estimates that, while considered reasonable by management based on the business and markets in which Cordoba operates, are inherently subject to significant operational, economic, and competitive uncertainties, risks and contingencies. Such assumptions and estimates include, but are not limited to, assumptions with respect to the status of community relations and the security situation on site and in Colombia; general business and economic conditions; continuity of drilling programs; the availability of additional exploration and mineral project; the supply and demand for, inventories of, and the level and volatility of the prices of metals; relationships with strategic partners and significant shareholders; the timing and receipt of governmental permits and approvals; the timing and receipt of community and landowner approvals; changes in regulations; political factors; the accuracy of the Company’s interpretation of drill results; the geology, grade and continuity of the Company’s mineral deposits; the availability of equipment, skilled labour and services needed for the exploration and development of mineral properties; currency fluctuations; and impact of the COVID-19 pandemic.

There can be no assurance that forward-looking statements will prove to be accurate and actual results, and future events could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from the Company's expectations include actual exploration results, continuity of drilling programs, interpretation of metallurgical characteristics of the mineralization, changes in project parameters as plans continue to be refined, future metal prices, availability of capital and financing on acceptable terms, general economic, market or business conditions, uninsured risks, regulatory changes, delays or inability to receive required approvals, uncertainties relating to epidemics, pandemics and other public health crises, including COVID-19 or similar such viruses, and other exploration or other risks detailed herein and from time to time in the filings made by the Company with securities regulators, including those described under the heading “Risks and Uncertainties” in the Company’s most recently filed MD&A. The Company does not undertake to update or revise any forward-looking statements, except in accordance with applicable law. Readers are cautioned not to put undue reliance on these forward-looking statements.

1 Copper equivalent (“CuEq”) is calculated using the formula CuEq=((Copper%*Copper recovery)+100*((gold grade*gold price*gold recovery)/31.10305)/((copper%*copper price*copper recovery)*2204.62)+100*((silver grade*silver price*silver recovery)/31.10305)/((copper%*copper price*copper recovery)*2204.62) using the following assumptions: Metal prices of US$3.25/lb copper, US$1,600.00/oz gold, and US$20.00/oz silver, copper recovery of 92.5% (fresh and transition zone only), gold recovery of 78.1% and silver recovery of 62.9%.

2 Intervals are reported as core length only. True widths are estimated to be between 75% and 100% of the core length.