ACD174 Reports 140.9 Metres of 0.70% Copper Equivalent1

(0.42% Copper, 0.5 g/t Gold and 2.71 g/t Silver)

ACD177* Reports 223.00 Metres of 0.60% Copper Equivalent1

(0.47% Copper, 0.25 g/t Gold and 3.85 g/t Silver)

VANCOUVER, BRITISH COLUMBIA – Sarah Armstrong-Montoya, President and Chief Executive Officer of Cordoba Minerals Corp. (TSXV:CDB; OTCQB:CDBMF; otherwise “Cordoba” or the “Company”), is pleased to report the latest assay results received from the ongoing in-fill drilling program at the Alacran Copper-Gold-Silver Project.

Highlights:

Significant intercepts returned from the latest in-fill drill holes include (Table 1):

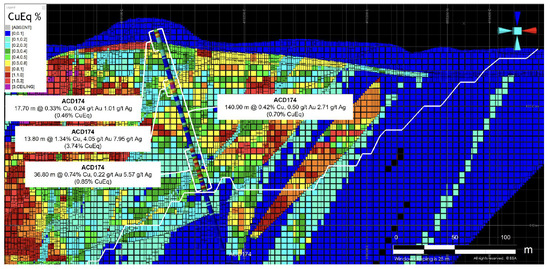

- ACD174 – 140.9 metres (“m”) from 15.6 m to 156.5 m with 0.42% copper (“Cu”), 0.50 g/t gold (“Au”) and 2.71 g/t silver (“Ag”), or 0.70% copper equivalent1

(“CuEq”), including:

- 13.80 m from 59.0 m to 72.8 m with 1.34% Cu, 4.05 g/t Au and 7.95 g/t Ag, or 3.74% CuEq1.

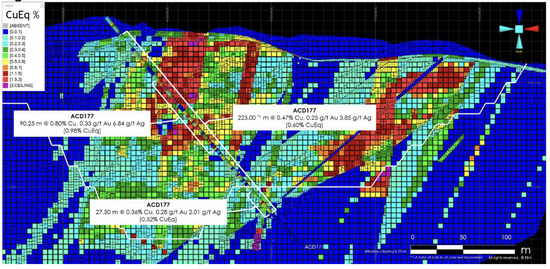

- ACD177* – 223.00 m from 27.00 m to 250.00 m with 0.47% Cu, 0.25 g/t Au and 3.85 g/t Ag, or 0.60% CuEq1, including:

- 90.25 m from 79.25 m to 169.50 m with 0.80% Cu, 0.33 g/t Au and 6.84 g/t Ag, or 0.98% CuEq1,

- 27.50 m from 222.5 m to 250.00 m with 0.36% Cu, 0.28 g/t Au and 2.01 g/t Ag, or 0.52% CuEq1.

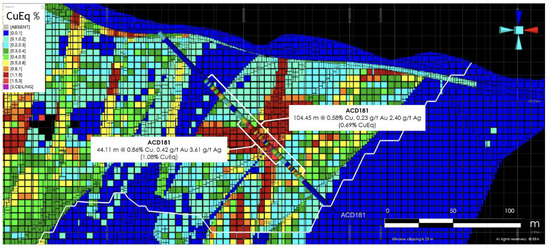

- ACD181 – 104.45 m from 61.55 m to 166.00 m with 0.58% Cu, 0.23 g/t Au and 2.40 g/t Ag, or 0.69% CuEq1, including:

- 44.11 m from 101.54 m to 145.65 m with 0.86% Cu, 0.42 g/t Au and 3.61 g/t Ag, or 1.08% CuEq1.

“As we move towards the end of the in-fill drilling program, I am pleased that the assay results continue to demonstrate the quality of the Alacran mineral resource model,” commented Sarah Armstrong-Montoya, President and CEO of Cordoba. “We continue to see high-grade mineralization in the north and central parts of the Alacran Deposit, which could be accessible during the early mining years.”

Additional drill holes further confirm the overall life of mine resource grades at the Alacran Deposit.

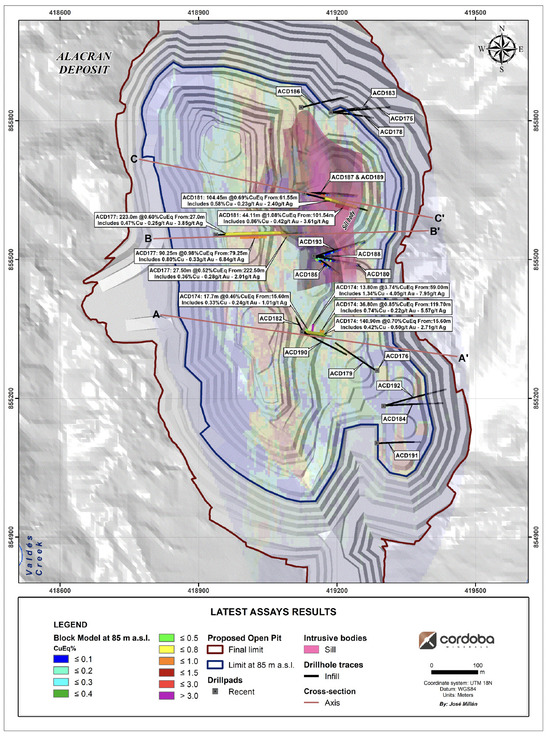

ACD174 and ACD177 tested the central part of the Alacran Deposit (Figure 1), and returned grades that are typical of the overall life of mine resource grade.

ACD174 returned 0.7% CuEq1 over 140.9 m from 15.6 m to 156.5 m (Figure 2). The hole demonstrates the local enrichment caused by the north-south trending structures. These structures intersect carbonate rich parts of the “Unit 2” stratigraphy, and result in preferential replacement of carbonates by sulfides, resulting in higher grades of 1.39% Cu, 0.46 g/t Au and 8.85 g/t Ag between 62 m and 63.8 m (Figure 7).

ACD177 returned 0.60% CuEq1 over 223.00 m from 27.00 m to 250.00 m (Figure 3), and further demonstrates both the broad intercept and local enrichment in the north-south trending structures, which intersected the carbonate rich portions of the “Unit 2” stratigraphy.

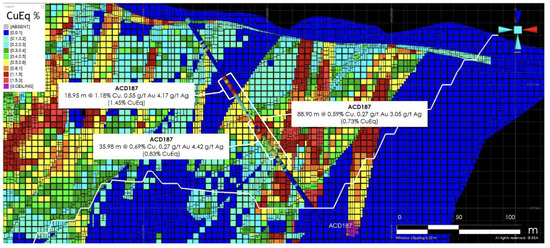

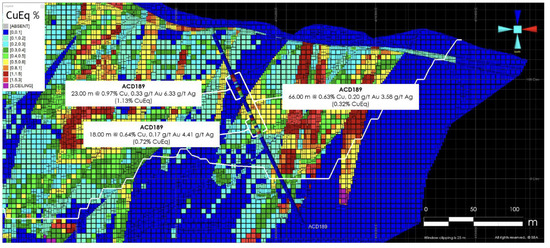

Drill holes ACD181, ACD187, and ACD189 have identified a 20 m thick sill in the east end of the Alacran Deposit (Figure 1). Although these drill holes intersected the sill, each drill hole also intersected the lower and higher grade mineralization on either side of the sill (Figures 4, 5, 6 and 8). The local volumes of mineralized material may be affected.

The ongoing drilling program will focus on the peripheral in-fill areas in the south of the Alacran Deposit where lower grades are expected as predicted by the Pre-Feasibility block model. The final hydrogeological, geotechnical, and infrastructure sterilization holes are expected to be completed within the next few weeks.

Table 1: Drill results of the latest drill holes from the Alacran Deposit second phase in-fill drilling program.

| Hole |

From (m) |

To

(m) |

Interval2

(m) |

Cu

(%) |

Au

(g/t) |

Ag

(g/t) |

CuEq1 (%) |

| ACD174 | 15.60 | 156.50 | 140.90 | 0.42 | 0.50 | 2.71 | 0.70 |

| Including | 15.60 | 33.30 | 17.70 | 0.33 | 0.24 | 1.01 | 0.46 |

| Including | 59.00 | 72.80 | 13.80 | 1.34 | 4.05 | 7.95 | 3.74 |

| Including | 119.70 | 156.50 | 36.80 | 0.74 | 0.22 | 5.57 | 0.85 |

| ACD175 * | 4.61 | 77.75 | 73.14 | 0.81 | 0.58 | 7.34 | 1.14 |

| Including* | 4.61 | 29.70 | 25.09 | 0.33 | 0.65 | 8.45 | 0.75 |

| Including | 43.30 | 77.75 | 34.45 | 1.43 | 0.69 | 9.30 | 1.80 |

| ACD176 | 40.69 | 68.60 | 27.91 | 1.05 | 0.11 | 4.08 | 1.06 |

| ACD177* | 27.00 | 250.00 | 223.00 | 0.47 | 0.25 | 3.85 | 0.60 |

| Including | 79.25 | 169.50 | 90.25 | 0.80 | 0.33 | 6.84 | 0.98 |

| Including | 222.5 | 250.00 | 27.50 | 0.36 | 0.28 | 2.01 | 0.52 |

| ACD178* | 12.10 | 77.50 | 65.40 | 0.74 | 0.40 | 3.69 | 0.95 |

| Including* | 12.10 | 28.30 | 16.20 | 1.81 | 0.49 | 6.86 | 2.01 |

| Including | 55.95 | 69.40 | 13.45 | 1.19 | 0.64 | 7.09 | 1.54 |

| ACD179 | 37.60 | 171.70 | 134.10 | 0.53 | 0.13 | 2.87 | 0.58 |

| Including | 37.60 | 79.00 | 41.40 | 0.64 | 0.16 | 1.96 | 0.70 |

| Including | 103.70 | 136.10 | 32.40 | 0.90 | 0.30 | 5.73 | 1.05 |

| Including | 161.60 | 171.70 | 10.10 | 0.64 | 0.01 | 5.59 | 0.63 |

| ACD180 | 93.80 | 126.00 | 32.20 | 0.28 | 0.17 | 1.27 | 0.37 |

| ACD181 | 61.55 | 166.00 | 104.45 | 0.58 | 0.23 | 2.40 | 0.69 |

| Including | 101.54 | 145.65 | 44.11 | 0.86 | 0.42 | 3.61 | 1.08 |

| ACD182* | 10.90 | 200.80 | 189.90 | 0.29 | 0.15 | 2.07 | 0.37 |

| Including | 68.10 | 83.65 | 15.55 | 0.75 | 0.57 | 4.21 | 1.06 |

| Including* | 90.45 | 134.70 | 44.25 | 0.47 | 0.18 | 3.47 | 0.57 |

| Including | 180.50 | 200.80 | 20.30 | 0.35 | 0.11 | 2.99 | 0.41 |

| ACD183* | 6.90 | 78.10 | 71.20 | 0.78 | 0.49 | 3.81 | 1.04 |

| Including* | 6.90 | 27.40 | 20.50 | 1.88 | 0.38 | 6.84 | 2.01 |

| Including | 57.71 | 78.10 | 20.39 | 1.19 | 0.65 | 6.28 | 1.54 |

| ACD184* | 11.75 | 73.85 | 62.10 | 0.36 | 0.14 | 0.82 | 0.42 |

| ACD185* | 40.90 | 148.00 | 107.10 | 0.34 | 0.29 | 1.62 | 0.50 |

| Including | 103.60 | 130.00 | 26.40 | 0.82 | 0.48 | 4.15 | 1.08 |

| ACD186* | 18.10 | 95.60 | 77.50 | 0.36 | 0.07 | 2.61 | 0.39 |

| Including* | 18.10 | 49.90 | 31.80 | 0.66 | 0.11 | 4.93 | 0.71 |

| Including | 86.00 | 95.60 | 9.60 | 0.73 | 0.16 | 5.21 | 0.81 |

| ACD187 | 63.50 | 152.40 | 88.90 | 0.59 | 0.27 | 3.05 | 0.73 |

| Including | 63.50 | 82.45 | 18.95 | 1.18 | 0.55 | 4.17 | 1.45 |

| Including | 105.17 | 141.15 | 35.98 | 0.69 | 0.27 | 4.42 | 0.83 |

| ACD188 | 107.85 | 139.00 | 31.15 | 0.27 | 0.16 | 1.47 | 0.35 |

| ACD189 | 61.00 | 127.00 | 66.00 | 0.52 | 0.20 | 3.53 | 0.63 |

| Including | 61.00 | 84.00 | 23.00 | 0.97 | 0.33 | 6.33 | 1.13 |

| Including | 109.00 | 127.00 | 18.00 | 0.64 | 0.17 | 4.41 | 0.72 |

| ACD190 | 78.80 | 161.40 | 82.60 | 0.23 | 0.13 | 1.68 | 0.30 |

| Including | 118.50 | 161.40 | 42.90 | 0.36 | 0.09 | 2.85 | 0.41 |

| ACD191* | 7.00 | 81.65 | 74.65 | 0.34 | 0.07 | 1.17 | 0.37 |

| ACD192 | 19.00 | 68.70 | 49.70 | 0.46 | 0.22 | 1.27 | 0.57 |

| ACD193 | 62.40 | 146.38 | 83.98 | 0.26 | 0.14 | 1.51 | 0.34 |

| Including | 86.90 | 104.29 | 17.39 | 0.57 | 0.32 | 3.14 | 0.74 |

1 Copper equivalent (“CuEq”) is calculated using the formula CuEq=((Copper%*Copper recovery)+100*((gold grade*gold price*gold recovery)/31.10305)/((copper%*copper price*copper recovery)*2204.62)+100*((silver grade*silver price*silver recovery)/31.10305)/((copper%*copper price*copper recovery)*2204.62) using the following assumptions: Metal prices of US$3.25/lb copper, US$1,600.00/oz gold, and US$20.00/oz silver, copper recovery of 92.5% (fresh and transition zone only), gold recovery of 78.1% and silver recovery of 62.9%. Comprehensive metallurgical test programs have been completed which has led to the creation of head grade/recovery algorithms by principal rock type. Details are outlined with the Pre-Feasibility Study.

2 Intervals are reported as core length only. True widths are estimated to be between 75% and 100% of the core length.

* Drill hole has partial core recovery due to poor ground conditions, which is why the from-to lengths do not equate to the sampled intervals.

Figure 1: Plan view of the latest significant intercepts from the ongoing in-fill drilling program.

Figure 2: Cross Section A-A’ of ACD174

Figure 3: Cross Section B-B’ of ACD177

Figure 4: Cross Section C-C’ of ACD181

Figure 5: Cross Section C-C’ of ACD187

Figure 6: Cross Section C-C’ of ACD189

Figure 7: ACD174 at 62.5 m down hole – a fossiliferous limestone bed that is highly replaced by semi-massive sulfides consisting of pyrite, chalcopyrite and trace magnetite. The sample outlines some of the bivalves whose carbonate shells have been preferentially replaced. The host limestone protolith shows pervasive chlorite alteration. This sample was part of 1.8 m interval between 62 m and 63.8 m that returned 1.39% Cu, 0.46 g/t Au and 8.85 g/t Ag.

Figure 8: ACD187 at 80.05 m shows a grayish green fine tuff with extensive chalcopyrite mineralization, epidote and chlorite alteration. This sample was part of a 1.2 m interval between 79.1 m and 80.3 m that returned 1.87% Cu, 1.56 g/t Au and 8.29 g/t Ag.

Technical Information & Qualified Person

The technical information in this release has been reviewed, verified and approved by Mark Gibson, P.Geo., a Qualified Person for the purpose of National Instrument 43-101 – Standards of Disclosure for Mineral Project (“NI 43-101”). Mr. Gibson is the Chief Operating Officer of Cordoba and of Ivanhoe Electric Inc., Cordoba’s majority shareholder, and is not considered independent under NI 43-101. Mr. Gibson verified the data disclosed which includes a review of the sampling, analytical and test data underlying the information and opinions contained therein.

Quality Assurance/Quality Control

Cordoba uses ALS Minerals Laboratory in Medellin, Colombia, ALS Minerals Laboratory in Lima, Peru, and SGS Colombia S.A.S in Medellin, Colombia. These labs operate in accordance with ISO/IEC 17025.

Cordoba employs a comprehensive industry standard Quality Assurance/Quality Control (QA/QC) program. PQ and HQ diamond drill core is cut lengthwise into 3 fractions, 1/4 is sent to geochemistry, half is sent to metallurgy, and 1/4 is left behind in a secure facility for future assay verification.

Some sample shipments are delivered to ALS Minerals Laboratory in Medellin, Colombia where the samples are prepared. Analysis occurs at the ALS Minerals Laboratory in Lima, Peru.

Alternate sample shipments are delivered to SGS Colombia S.A.S in Medellin, Colombia where the samples are prepared and analyzed.

Both analytical labs determine the gold by a 50 g fire assay with an AAS finish. An initial multi- element suite comprising copper, molybdenum, silver, and additional elements are analyzed by four-acid digestion with an ICP-MS finish. All samples with copper values over 10,000 ppm and gold greater than 10 ppm are subjected to an overlimit method for higher grades, which also uses a four-acid digest with an ICP-ES finish, and fire test with gravimetric finish. Certified reference materials, blanks, and duplicates are randomly inserted at the geologist's discretion and QA/QC geologist's approval into the sample stream to control laboratory performance (15%).

About Cordoba

Cordoba Minerals Corp. is a mineral exploration company focused on the exploration, development and acquisition of copper and gold projects. Cordoba is jointly developing the Alacran Project with JCHX Mining Management Co., Ltd., located in the Department of Cordoba, Colombia. Cordoba also holds a 51% interest in the Perseverance Copper Project in Arizona, USA, which it is exploring through a Joint Venture and Earn-In Agreement. For further information, please visit www.cordobaminerals.com.

ON BEHALF OF THE COMPANY

Sarah Armstrong-Montoya, President and Chief Executive Officer

Information Contact

Ran Li +1-604-689-8765

info@cordobamineralscorp.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accept responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements

This news release includes “forward-looking statements” and “forward-looking information” within the meaning of Canadian securities legislation. All statements included in this news release, other than statements of historical fact, are forward-looking statements including, without limitation, but not limited to, statements with respect to the Alacran Deposit and development thereof; geological interpretations; results of the current exploration and interpretations thereof; mineralization potential; and drilling programs. Forward looking-statements include predictions, projections and forecasts and are often, but not always, identified by the use of words such as "anticipate", "believe", "plan", "estimate", "expect", "potential", "target", "budget" and "intend" and statements that an event or result "may", "will", "should", "could" or "might" occur or be achieved and other similar expressions and includes the negatives thereof.

Forward-looking statements are based on a number of assumptions and estimates that, while considered reasonable by management based on the business and markets in which Cordoba operates, are inherently subject to significant operational, economic, and competitive uncertainties, risks and contingencies. Such assumptions and estimates include, but are not limited to, assumptions with respect to the status of community relations and the security situation on site and in Colombia; general business and economic conditions; continuity of drilling programs; the availability of additional exploration and mineral project capital and financing; the supply and demand for, inventories of, and the level and volatility of the prices of metals; relationships with strategic partners and significant shareholders; the timing and receipt of governmental permits and approvals; the timing and receipt of community and landowner approvals; changes in regulations; political factors; the accuracy of the Company’s interpretation of drill results; the geology, grade and continuity of the Company’s mineral deposits; the availability of equipment, skilled labour and services needed for the exploration and development of mineral properties; currency fluctuations; and impact of the COVID-19 pandemic.

There can be no assurance that forward-looking statements will prove to be accurate and actual results, and future events could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from the Company's expectations include actual exploration results, continuity of drilling programs, interpretation of metallurgical characteristics of the mineralization, changes in project parameters as plans continue to be refined, future metal prices, availability of capital and financing on acceptable terms, general economic, market or business conditions, risks related to community relations and the security situation on site and in Colombia; uninsured risks, regulatory changes, delays or inability to receive required approvals, uncertainties relating to epidemics, pandemics and other public health crises, including COVID-19 or similar such viruses, and other exploration or other risks detailed herein and from time to time in the filings made by the Company with securities regulators, including those described under the heading “Risks and Uncertainties” in the Company’s most recently filed MD&A. The Company does not undertake to update or revise any forward-looking statements, except in accordance with applicable law. Readers are cautioned not to put undue reliance on these forward-looking statements.