ACD162 Reports 150.7 Metres* of 0.74% Copper Equivalent1

(0.59% Copper, 0.28 g/t Gold and 4.19 g/t Silver)

ACD170 Reports 77.48 Metres of 1.68% Copper Equivalent1

(1.24% Copper, 0.82 g/t Gold and 6.78 g/t Silver)

VANCOUVER, BRITISH COLUMBIA – Sarah Armstrong-Montoya, President and Chief Executive Officer of Cordoba Minerals Corp. (TSXV:CDB; OTCQB:CDBMF; otherwise “Cordoba” or the “Company”), is pleased to report the assay results received from the ongoing in-fill drilling program at the San Matias Copper-Gold-Silver Project.

Highlights:

Significant intercepts returned from the latest in-fill drill holes include (Table 1):

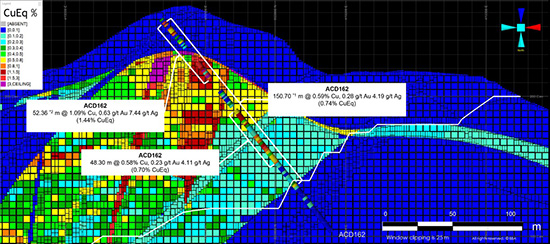

- ACD162 – 150.7 metres* (“m”) from 4.8 m to 155.5 m with 0.59% copper (“Cu”), 0.28 g/t gold (“Au”) and 4.19 g/t silver (“Ag”), or 0.74% copper equivalent1 (“CuEq”), including:

- 52.36 m from 4.8 m to 57.16 m with 1.09% Cu, 0.63 g/t Au and 7.44 g/t Ag, or 1.44% CuEq1,

- 48.3 m from 85.7 to 134 m with 0.58% Cu, 0.23 g/t Au and 4.11 g/t Ag, or 0.70 % CuEq1.

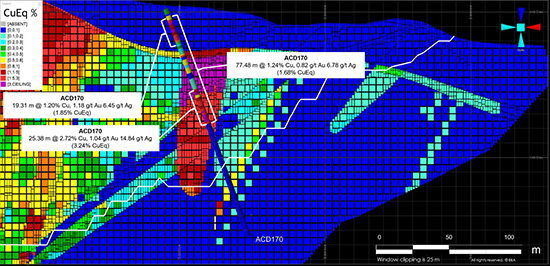

- ACD170 – 77.48 m from 6.6 m to 84.08 m with 1.24% Cu, 0.82 g/t Au and 6.78 g/t Ag, or 1.68% CuEq1, including:

- 19.31 m from 6.6 m to 25.91 m with 1.20% Cu, 1.18 g/t Au and 6.45 g/t Ag, or 1.85% CuEq1,

- 25.38 m from 58.7 m to 84.08 m with 2.72% Cu, 1.04 g/t Au and 14.84 g/t Ag, or 3.24% CuEq1.

Assay results returned shallow high-grade copper-gold mineralization in the north of the Alacran Deposit with long intervals of over 1% CuEq1 from drill holes ACD162 and ACD170 (Figures 2 and 3).

“I’m delighted to see that the in-fill drilling program continues to deliver encouraging assay results, especially in the north of the Alacran Deposit,” commented Sarah Armstrong-Montoya, President and CEO of Cordoba. “The initial in-fill drilling confirms the high-grade copper-gold mineralization within the core of the Alacran Deposit, and it is anticipated that the second phase in-fill drilling campaign will continue to confirm the Pre-Feasibility block model in the peripheral areas of the Deposit.”

High-grade intervals identified at the north of the Alacran Deposit.

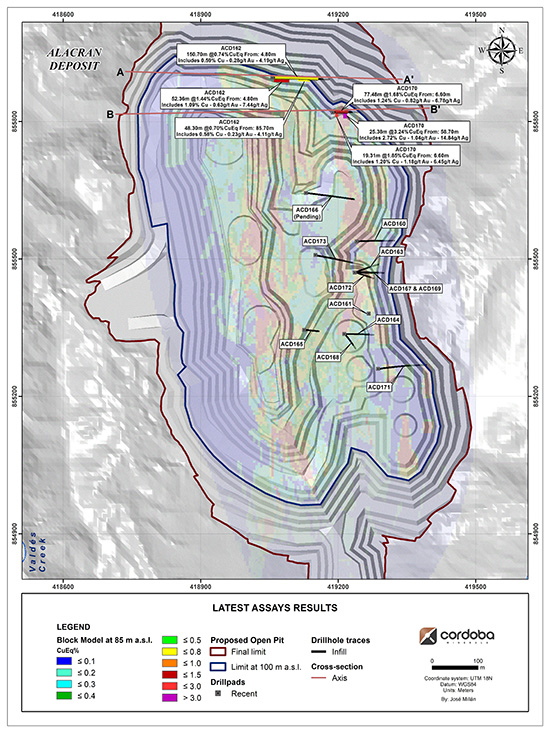

The initial in-fill drilling campaign completed 27,726 m in 142 diamond drill holes within the core of the Alacran Deposit and confirms the strong correlation with the Pre-Feasibility Study (“PFS”) block model. The ongoing second phase in-fill drilling program focuses on the peripheral in-fill areas to confirm the life of mine average grade estimate of the Alacran Deposit (Figure 1).

ACD162 and ACD170 drill tested the north of the Alacran Deposit and returned with highly enriched grades of copper, gold and silver mineralization (Figures 2 and 3). ACD162 returned 150.7 m from 4.8 m to 155.5 m of 0.74% CuEq1, with a particularly high-grade zone from 4.8 m to 57.16 m of 1.44 CuEq1. This zone sampled a fossil rich limestone at the top of ‘Unit 2’ – the stratigraphic horizon that hosts most of the mineralization at Alacran (Figure 4). ACD170 intersected semi-massive sulfides within the lower part of the ‘Unit 2’ stratigraphy (Figure 5), which have been frequently seen in earlier drilling nearby (refer to Cordoba’s news releases dated January 23, 2023 and December 5, 2022).

Drill holes ACD160, 164 and 171 drill tested the peripheral in-fill areas in the south of the Alacran Deposit and returned with relatively lower grades as predicted by the PFS block model. The PFS planned this area to be mined later in the mine life.

Corporate Update

Cordoba has arranged a short-term loan of US$4 million (the "Bridge Loan") from its majority shareholder, Ivanhoe Electric Inc. (“IE”). The Bridge Loan will be evidenced on a new grid promissory note and bears interest at 12% per annum, compounding only at maturity. The interest rate will increase to 14% per annum if Cordoba does not repay the amount owing upon the maturity date, which is the earlier of May 15, 2023 and the closing of any equity or debt financing by Cordoba. The purpose of the Bridge Loan is to ensure the Company is able to continue exploration activities on its mineral projects and for general corporate purposes.

Table 1: Drill results of the drill holes from the Alacran Deposit second phase in-fill drilling program.

| Hole | From (m) |

To (m) |

Interval2 (m) |

Cu (%) |

Au (g/t) |

Ag (g/t) |

CuEq1 (%) |

| ACD160 | 18.00 | 104.80 | 86.80 | 0.28 | 0.08 | 2.02 | 0.32 |

| Including | 86.60 | 104.80 | 18.20 | 0.73 | 0.12 | 5.31 | 0.78 |

| ACD161* | 3.80 | 94.85 | 91.05 | 0.42 | 0.12 | 2.42 | 0.48 |

| Including | 29.66 | 54.35 | 24.69 | 0.73 | 0.17 | 3.24 | 0.80 |

| Including | 84.00 | 94.85 | 10.85 | 0.80 | 0.20 | 7.18 | 0.90 |

| ACD162 * | 4.80 | 155.50 | 150.70 | 0.59 | 0.28 | 4.19 | 0.74 |

| Including* | 4.80 | 57.16 | 52.36 | 1.09 | 0.63 | 7.44 | 1.44 |

| Including | 85.70 | 134.00 | 48.30 | 0.58 | 0.23 | 4.11 | 0.70 |

| ACD163 | 27.80 | 67.80 | 40.00 | 0.64 | 0.20 | 2.76 | 0.73 |

| Including | 36.80 | 50.00 | 13.20 | 1.08 | 0.37 | 4.39 | 1.25 |

| ACD164 | 21.10 | 104.60 | 83.50 | 0.40 | 0.15 | 2.06 | 0.47 |

| Including | 21.10 | 48.20 | 27.10 | 0.40 | 0.13 | 1.86 | 0.46 |

| Including | 93.43 | 104.60 | 11.17 | 1.30 | 0.47 | 6.34 | 1.53 |

| ACD165* | 16.40 | 88.10 | 71.70 | 0.29 | 0.18 | 1.26 | 0.39 |

| Including* | 16.40 | 40.70 | 24.30 | 0.42 | 0.19 | 1.24 | 0.51 |

| Including | 58.80 | 70.00 | 11.20 | 0.58 | 0.59 | 3.25 | 0.91 |

| ACD166 | 61.00 | 145.70 | 84.7 | 0.86 | 0.36 | 4.58 | 1.04 |

| ACD167 * | 24.40 | 73.30 | 48.90 | 0.29 | 0.08 | 0.95 | 0.32 |

| ACD168 | 12.15 | 119.10 | 106.95 | 0.65 | 0.22 | 4.71 | 0.76 |

| Including | 12.15 | 51.40 | 39.25 | 0.74 | 0.26 | 4.48 | 0.87 |

| Including | 56.18 | 67.68 | 11.50 | 0.96 | 0.17 | 6.54 | 1.04 |

| Including | 79.50 | 97.45 | 17.95 | 0.64 | 0.07 | 5.36 | 0.67 |

| Including | 108.30 | 119.10 | 10.80 | 1.56 | 0.92 | 13.88 | 2.08 |

| ACD169 | 18.00 | 58.20 | 40.20 | 0.25 | 0.16 | 1.50 | 0.34 |

| ACD170 | 6.60 | 84.08 | 77.48 | 1.24 | 0.82 | 6.78 | 1.68 |

| Including | 6.60 | 25.91 | 19.31 | 1.20 | 1.18 | 6.45 | 1.85 |

| Including | 58.70 | 84.08 | 25.38 | 2.72 | 1.04 | 14.84 | 3.24 |

| ACD171 | 30.00 | 63.70 | 33.70 | 0.40 | 0.40 | 2.04 | 0.62 |

| ACD172 | 27.40 | 60.00 | 32.60 | 0.52 | 0.17 | 1.41 | 0.59 |

| ACD173 | 105.15 | 134.64 | 29.49 | 0.30 | 0.33 | 1.26 | 0.48 |

1 Copper equivalent (“CuEq”) is calculated using the formula CuEq=((Copper%*Copper recovery)+100*((gold grade*gold price*gold recovery)/31.10305)/((copper%*copper price*copper recovery)*2204.62)+100*((silver grade*silver price*silver recovery)/31.10305)/((copper%*copper price*copper recovery)*2204.62) using the following assumptions: Metal prices of US$3.25/lb copper, US$1,600.00/oz gold, and US$20.00/oz silver, copper recovery of 92.5% (fresh and transition zone only), gold recovery of 78.1% and silver recovery of 62.9%.

2 Intervals are reported as core length only. True widths are estimated to be between 75% and 100% of the core length.

* Holes ACD161, 162, 165 and 167 had partial core recovery, which is why the from-to lengths do not equate to the sampled intervals.

Figure 1: Plan view of the significant intercepts from the latest ongoing in-fill drilling program.

Figure 2: Cross Section A – A’ of ACD162

Figure 3: Cross Section B – B’ of ACD170

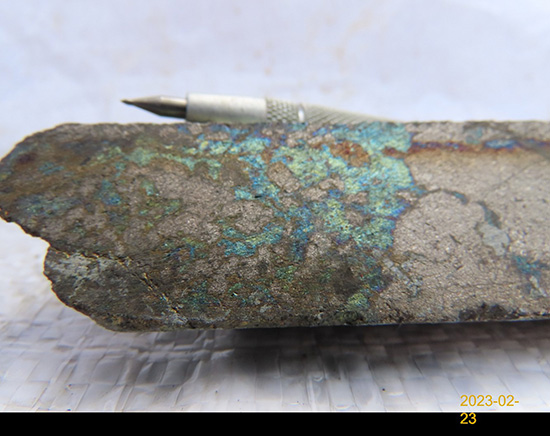

Figure 4: Hole ACD162 at 43.10 m below collar, which was at the top of a 1-m sample grading 3.68% CuEq1 with much of the carbonate replaced by chalcopyrite and pyrrhotite. In addition, there was less saprolite intersected in ACD162 than predicted, which should have a positive contribution to the resource update.

Figure 5: Hole ACD170 at 79.40 m below collar, which was part of a 1-m sample grading 8.86% CuEq1, with carbonaceous mudstones and tuffs almost completely replaced by chalcopyrite, pyrrhotite and pyrite. This replacement appears to be controlled by the north-south high-grade structural domain seen in cross section in Figure 3.

Technical Information & Qualified Person

The technical information in this release has been reviewed, verified and approved by Mark Gibson, P.Geo., a Qualified Person for the purpose of National Instrument 43-101 – Standards of Disclosure for Mineral Project (“NI 43-101”). Mr. Gibson is the Chief Operating Officer of Cordoba and of Ivanhoe Electric Inc., Cordoba’s majority shareholder, and is not considered independent under NI 43-101. Mr. Gibson verified the data disclosed which includes a review of the sampling, analytical and test data underlying the information and opinions contained therein.

Quality Assurance/Quality Control

Cordoba uses ALS Minerals Laboratory in Medellin, Colombia, ALS Minerals Laboratory in Lima, Peru, and SGS Colombia S.A.S in Medellin, Colombia. These labs operate in accordance with ISO/IEC 17025.

Cordoba employs a comprehensive industry standard Quality Assurance/Quality Control (QA/QC) program. PQ and HQ diamond drill core is cut lengthwise into 3 fractions, 1/4 is sent to geochemistry, half is sent to metallurgy, and 1/4 is left behind in a secure facility for future assay verification.

Some sample shipments are delivered to ALS Minerals Laboratory in Medellin, Colombia where the samples are prepared. Analysis occurs at the ALS Minerals Laboratory in Lima, Peru.

Alternate sample shipments are delivered to SGS Colombia S.A.S in Medellin, Colombia where the samples are prepared and analyzed.

Both analytical labs determine the gold by a 50 g fire assay with an AAS finish. An initial multi- element suite comprising copper, molybdenum, silver, and additional elements are analyzed by four-acid digestion with an ICP-MS finish. All samples with copper values over 10,000 ppm and gold greater than 10 ppm are subjected to an overlimit method for higher grades, which also uses a four-acid digest with an ICP-ES finish, and fire test with gravimetric finish. Certified reference materials, blanks, and duplicates are randomly inserted at the geologist's discretion and QA/QC geologist's approval into the sample stream to control laboratory performance (15%).

The Bridge Loan

The Bridge Loan constitutes a "related party transaction" under Multilateral Instrument 61-101 - Protection of Minority Security Holders in Special Transactions (“MI 61-101”) as IE is a related party of Cordoba given its greater than 10% beneficial shareholding. Pursuant to Section 5.7(1)(f) of MI 61-101, the Company is exempt from obtaining minority approval of the Company's shareholders in respect of the Bridge Loan because it was determined that the Bridge Loan is on reasonable commercial terms that are not less advantageous to the Company than if the Bridge Loan was obtained from a person dealing at arm’s length with the Company and because the Bridge Loan is not convertible into, or repayable in, equity or voting securities of the Company or a subsidiary of the Company or otherwise participating in nature. The Company will file a material change report in respect of the Bridge Loan. However, the material change report will be filed less than 21 days prior to the closing of the Bridge Loan, which is consistent with market practice and which the Company deems is reasonable in the circumstances.

About Cordoba

Cordoba Minerals Corp. is a mineral exploration company focused on the exploration, development and acquisition of copper and gold projects. Cordoba is developing the San Matias Copper-Gold-Silver Project, which includes the Alacran deposit and satellite deposits at Montiel East, Montiel West and Costa Azul, located in the Department of Cordoba, Colombia. The Company has entered into a strategic arrangement with JCHX Mining Management Co., Ltd., pursuant to which JCHX will acquire 50% of the Alacran Project and the parties will jointly develop the Project. The Company anticipates the strategic arrangement will close around the end of the second quarter of 2023, on satisfaction or waiver of all conditions to completion. Cordoba also holds a 51% interest in the Perseverance Copper Project in Arizona, USA, which it is exploring through a Joint Venture and Earn-In Agreement. For further information, please visit www.cordobaminerals.com.

ON BEHALF OF THE COMPANY

Sarah Armstrong-Montoya, President and Chief Executive Officer

Information Contact

Ran Li +1-604-689-8765

info@cordobamineralscorp.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accept responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements

This news release includes “forward-looking statements” and “forward-looking information” within the meaning of Canadian securities legislation. All statements included in this news release, other than statements of historical fact, are forward-looking statements including, without limitation, but not limited to, statements with respect to the Alacran Deposit and development thereof; strategic arrangement with JCHX; geological interpretations; results of the current exploration and interpretations thereof; mineralization potential; and contemplated drilling and development programs; the Bridge Loan, including the drawdown, repayment schedule and intended purposes of the Bridge Loan; additional advances by IE; and filing of a material change report on the Bridge Loan. Forward looking-statements include predictions, projections and forecasts and are often, but not always, identified by the use of words such as "anticipate", "believe", "plan", "estimate", "expect", "potential", "target", "budget" and "intend" and statements that an event or result "may", "will", "should", "could" or "might" occur or be achieved and other similar expressions and includes the negatives thereof.

Forward-looking statements are based on a number of assumptions and estimates that, while considered reasonable by management based on the business and markets in which Cordoba operates, are inherently subject to significant operational, economic, and competitive uncertainties, risks and contingencies. Such assumptions and estimates include, but are not limited to, assumptions with respect to the status of community relations and the security situation on site and in Colombia; general business and economic conditions; continuity of drilling programs; the availability of additional exploration and mineral project capital and financing; the supply and demand for, inventories of, and the level and volatility of the prices of metals; relationships with strategic partners and significant shareholders; the timing and receipt of governmental permits and approvals; the timing and receipt of community and landowner approvals; changes in regulations; political factors; the accuracy of the Company’s interpretation of drill results; the geology, grade and continuity of the Company’s mineral deposits; the availability of equipment, skilled labour and services needed for the exploration and development of mineral properties; currency fluctuations; and impact of the COVID-19 pandemic.

There can be no assurance that forward-looking statements will prove to be accurate and actual results, and future events could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from the Company's expectations include actual exploration results, continuity of drilling programs, interpretation of metallurgical characteristics of the mineralization, changes in project parameters as plans continue to be refined, future metal prices, availability of capital and financing on acceptable terms, general economic, market or business conditions, risks related to community relations and the security situation on site and in Colombia; uninsured risks, regulatory changes, delays or inability to receive required approvals, uncertainties relating to epidemics, pandemics and other public health crises, including COVID-19 or similar such viruses, and other exploration or other risks detailed herein and from time to time in the filings made by the Company with securities regulators, including those described under the heading “Risks and Uncertainties” in the Company’s most recently filed MD&A. The Company does not undertake to update or revise any forward-looking statements, except in accordance with applicable law. Readers are cautioned not to put undue reliance on these forward-looking statements.